🍣 SushiSwap: A Complete Guide to the DeFi Powerhouse in 2025

In the ever-evolving world of decentralized finance (DeFi), few names stand out like SushiSwap. What began as a fork of Uniswap has grown into a dynamic ecosystem packed with powerful tools, community-driven governance, and impressive earning opportunities. Whether you're a crypto newbie or an experienced yield farmer, SushiSwap offers something valuable for everyone.

In this blog, we’ll dive deep into what SushiSwap is, how it works, its unique features, and why it remains one of the most innovative DeFi platforms in 2025.

🎯 What is SushiSwap?

SushiSwap is a decentralized exchange (DEX) built on the Ethereum blockchain that allows users to swap, earn, stack yields, lend, borrow, and more—all without intermediaries.

Launched in August 2020, SushiSwap quickly gained popularity for being community-focused and offering SUSHI, its native governance and utility token. Over the years, it expanded to multiple blockchains and introduced innovative products that go far beyond simple token swaps.

🔍 Key Features of SushiSwap

1. 🌀 Decentralized Token Swaps

SushiSwap allows users to instantly swap ERC-20 tokens in a peer-to-peer manner. These transactions are governed by smart contracts, offering a trustless and permissionless experience.

2. 💸 Liquidity Pools

Anyone can become a liquidity provider (LP) by depositing pairs of tokens. In return, LPs earn a share of the trading fees plus SUSHI rewards—making it an attractive option for passive income seekers.

3. 🌾 Yield Farming

By staking LP tokens, users can earn additional SUSHI rewards through yield farming. These farms often offer higher APYs than traditional DeFi protocols.

4. 🎮 Kashi – Isolated Lending & Borrowing

Kashi is SushiSwap’s lending and margin trading platform, enabling users to create isolated lending pairs and leverage positions in a low-risk environment.

5. 🛠️ BentoBox – Vault System

BentoBox is a token vault that allows multiple DeFi protocols to interact efficiently, reducing gas fees and improving scalability. Kashi, Trident, and other dApps on Sushi are built on BentoBox.

6. 🌉 Multi-Chain Deployment

SushiSwap supports multiple blockchains including:

- Ethereum

- Arbitrum

- Optimism

- Polygon

- BNB Chain

- Avalanche

- Fantom

- Base This allows users to interact with DeFi wherever they prefer.

💡 How SushiSwap Works

SushiSwap is powered by Automated Market Makers (AMMs), a system where liquidity pools set token prices based on a mathematical formula. Here's a simplified process:

- A user swaps Token A for Token B.

- The liquidity pool adjusts the ratio of tokens based on the trade size.

- The trader pays a small fee (usually 0.3%).

- LPs earn a portion of the fees, and some pools offer SUSHI rewards.

🪙 What is the SUSHI Token?

The SUSHI token is the lifeblood of the SushiSwap ecosystem. It serves multiple purposes:

- Governance: Vote on protocol changes, development proposals, and treasury usage.

- Staking (xSUSHI): Stake SUSHI to earn a share of trading fees.

- Incentives: Reward liquidity providers and yield farmers.

Tokenomics:

- Total Supply: 250 million SUSHI

- Circulating Supply: ~230 million (as of 2025)

- Distribution: Community-focused with minimal VC involvement

🔒 Is SushiSwap Safe?

While SushiSwap has been audited and battle-tested, it's still a DeFi protocol, which carries inherent risks:

- Smart contract vulnerabilities

- Impermanent loss for liquidity providers

- Governance attacks if malicious actors gain control

Still, SushiSwap has taken major steps to ensure security, such as:

- Regular audits

- Bug bounties

- Transparent governance

Tip: Only invest what you can afford to lose and consider using hardware wallets for security.

📊 SushiSwap vs Uniswap

FeatureSushiSwapUniswapGovernanceCommunity-ledVC-backedYield FarmingYesNo (on Uniswap V3)LendingYes (Kashi)NoStakingYes (xSUSHI)NoFee DistributionTo SUSHI stakersTo liquidity providersMulti-ChainYesLimited (Ethereum L2s)

Verdict: SushiSwap offers a more versatile ecosystem, especially for those looking to earn passive income.

📈 How to Use SushiSwap – A Quick Guide

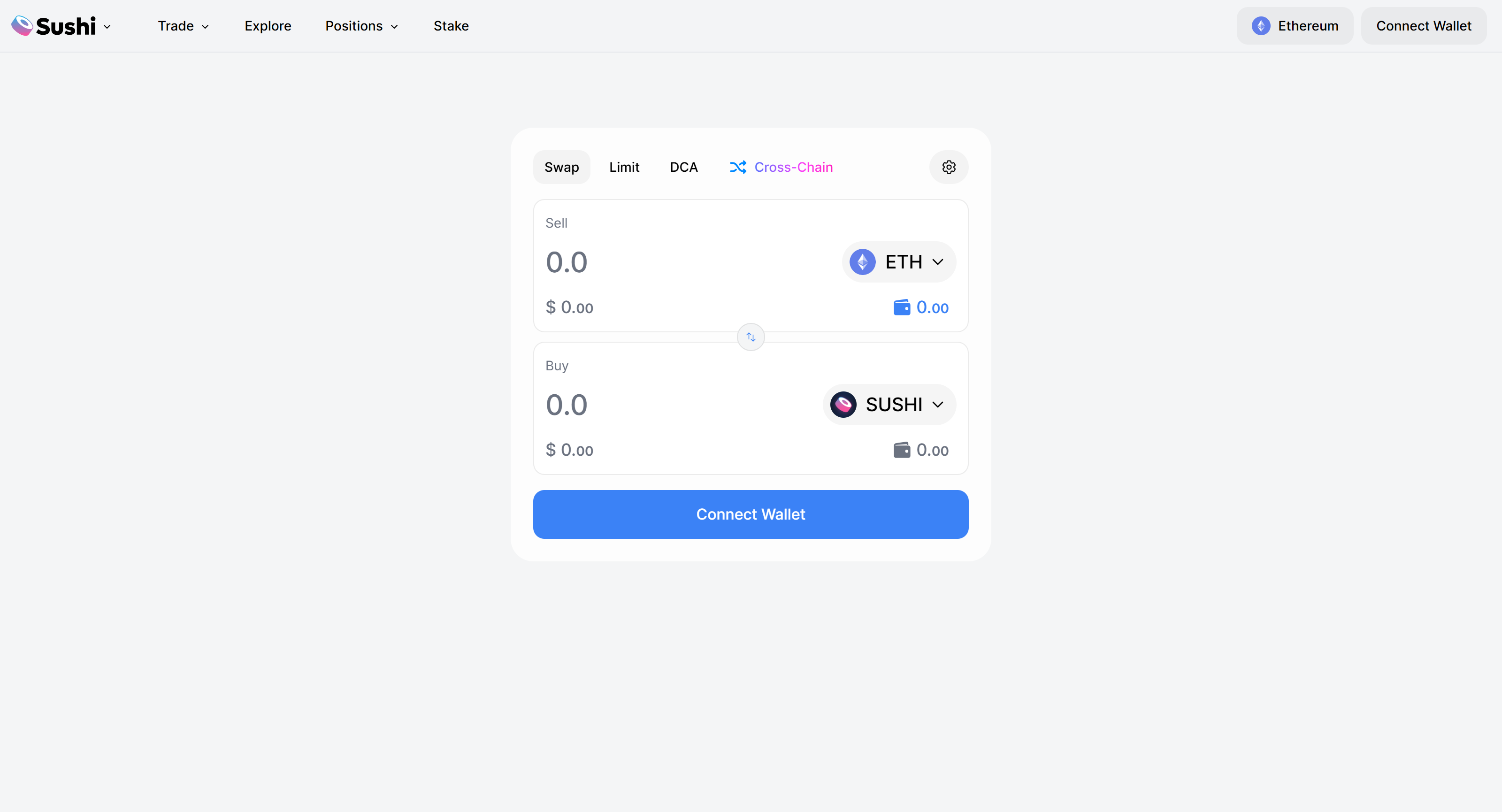

✅ Step 1: Connect Wallet

Connect your wallet (MetaMask, WalletConnect, Coinbase Wallet, etc.) to the SushiSwap interface.

🔁 Step 2: Swap Tokens

Choose the token pair you want to swap, enter the amount, and confirm the transaction.

💧 Step 3: Add Liquidity

Provide equal amounts of two tokens to a liquidity pool and receive LP tokens.

🧑🌾 Step 4: Yield Farm

Stake your LP tokens into a yield farm to earn SUSHI rewards.

📥 Step 5: Stake SUSHI

Convert your SUSHI into xSUSHI and earn a portion of platform fees.

🌍 SushiSwap Ecosystem Expansion (2025)

SushiSwap is no longer just a DEX. It’s now a comprehensive DeFi suite. Here’s what’s trending in 2025:

1. SushiXSwap

A cross-chain swap protocol allowing users to move assets between chains in one click.

2. Trident

An advanced AMM system focused on capital efficiency, built on BentoBox, offering customizable pool types.

3. Sushi Studios

A DAO-funded incubator supporting DeFi innovation through grants and developer support.

🧠 Tips for Maximizing SushiSwap

- Use Layer 2s (like Arbitrum, Optimism) to reduce gas fees.

- Stake SUSHI to earn passive rewards while holding.

- Check APRs before farming – some farms offer much higher returns.

- Participate in governance – your vote helps shape the platform.

- Diversify – spread your assets across multiple pools to reduce risk.

🌐 Community & Governance

SushiSwap prides itself on being community-driven. Key governance tools include:

- Snapshot Voting: For protocol decisions.

- Forum Discussions: Share ideas or raise concerns.

- Core Team Transparency: Regular updates from developers.

SushiSwap has seen a resurgence in active development and community involvement since mid-2023, and the trend continues in 2025.

🔮 SushiSwap’s Future in 2025 and Beyond

With its cross-chain capabilities, new AMM models, and expanded DeFi tools, SushiSwap is positioning itself as a full-stack DeFi platform. As more users embrace decentralization, SushiSwap could play a key role in onboarding millions into the DeFi space.

Expect innovations like:

- Gasless trading

- Improved mobile interfaces

- AI-integrated DeFi strategies

- Better DAO tooling

📝 Conclusion

SushiSwap started as a bold experiment but has matured into a DeFi powerhouse. With a wide range of tools, solid community support, and continuous innovation, SushiSwap is one of the most promising and user-friendly DEXs on the market today.

Whether you're swapping tokens, providing liquidity, farming yields, or staking SUSHI, SushiSwap gives you the power to control your own financial destiny—without banks, brokers, or boundaries.

Explore more at 👉 https://sushi.com Start swapping, staking, and earning today! 🍣

Made in Typedream